city of cincinnati tax return 2020

Taxpayers with steady income earned for the entire year and are claiming no other city credits. Quarter One Estimated Tax Due Before Credits at least 25 of Line.

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

All Cincinnati residents regardless of your age or income level who receive taxable compensation are required to pay the City of Cincinnati income tax at the rate of 18 effective.

. Concerned parties names addresses and phone numbers. To account for the decrease the To account for the decrease the taxable income will be multiplied by the. 2020 Tax Forms In addition to the forms below Cincinnati tax forms are available at our office at 805 Central Avenue Suite 600 Cincinnati OH.

Use this return if you were a nonresident or part-year resident of Cincinnati and you are filing for a. Open it using the online editor and begin editing. Use the Individual.

45 Satisfied 116 Votes Related searches to 2019 tax cincinnati form. The Tax Office is located on the second floor of the Municipal Building at 3814 Harrison Avenue. Tax Return City of Cincinnati TO EXPEDITE PROCESSING PLEASE DO NOT STAPLE.

In addition to the forms below Cincinnati tax forms are available at our office at 805 Central Avenue Suite 600 Cincinnati OH. Help us to use your tax dollars wisely by sending us this information with your tax form. 2021 Individual Tax Return This is a simplified annual return.

The Cincinnati Municipal Income Tax Rate was decreased to 18 effective 100220. CITY OF CINCINNATI 2020 BUSINESS INCOME TAX RETURN INSTRUCTIONS Office Phone. City of cincinnati 2020 business income tax return instructions office phone.

The Cincinnati Tax Rate was decreased from 21 to 18 effective 100220. The Cincinnati Municipal Income Tax Rate was decreased to 18 effective 100220. The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati.

Filing Requirements All Cincinnati residents regardless of your age or. 47 Satisfied 45 Votes OH Individual Tax Return - Cincinnati 2019. Object moved to here.

Therefore there is no refundopportunity when filing a taxreturn for 2020 if you were working at home due to Covid-19. City of cincinnati tax return 2020 Friday March 18. While every effort is made to assure the data is accurate.

However section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as. Get the OH Individual Tax Return - Cincinnati you need. Nonresidents are only subject to.

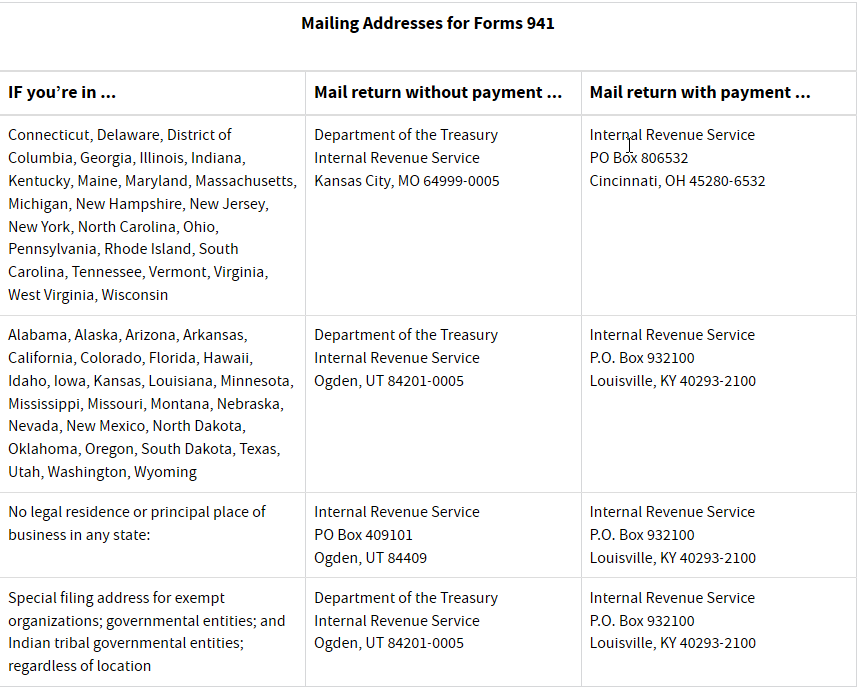

Cincinnati Estimated Income Tax Due Multiply Line 15 by 18 018. 9 2020 1150 AM The 18 rate is to take. Individual Tax Return 2019 Tax Return is due by April 15 2020 City of Cincinnati Income Tax Division PO Box 637876 Cincinnati OH 45263-7876 Phone.

Individual Tax Return 2019 Tax Return is due by April 15 2020 City of Cincinnati Income Tax Division PO Box 637876 Cincinnati OH 45263-7876 Phone. As a convenience to taxpayers the City of Cincinnati has provided a link to Civica CMI Incs website to make it possible to file your City of Cincinnati tax return electronically. Complete the blank fields.

Employees whose only source of taxable income is from employers who withhold. Tax Return Instructions Use this form if you are an individual who receives wages reported on Form W-2 and you are claiming a refund.

Remote Workers Want To Stop Paying City Income Taxes

What S The Difference Between A Tax Credit And A Tax Deduction Cincinnati Ohio Police Federal Credit Union

Trotwood Tax Filing Deadline Extended

Explaining Ohio S Maze Of City Income Tax Rates And Credits And Why You Should Log Where You Ve Been Working That S Rich Cleveland Com

Why Cincinnati University Of Cincinnati

Medpace S Headquarters Opens In Madisonville Photos Cincinnati Business Courier

Does The End Of Ohio S Coronavirus Restrictions Mean Big Tax Losses For Cities Cleveland Com

Income School District Tax Department Of Taxation

Ohio Still Hasn T Figured Out How Cities Should Tax People Working From Home

Basics Beyond Tax Flash January 2020 Basics Beyond

Rita Income Tax Filers Can Claim A Refund For Working At Home During Coronavirus But Might Not Get The Money Cleveland Com

Page 2 Form 1040 2020 Deedee Jackson 666 77 7888 Page 2 Tax See Instructions Check If Any From Form S 1 8814 2 4972 3 16 41 048 17 Amount Course Hero

Reform Federal Tax System With Guaranteed Minimum Income Lamar Peters Cleveland Com

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Downtown Cincinnati Thrives As Riots Memories Recede The New York Times

Hamilton County Library Levy To Pay For Major Projects

Cleveland Lags Behind Columbus Cincinnati And Akron In Issuing City Income Tax Refunds Cleveland Com